In today's digital age, remaining vigilant against potential fraud schemes is paramount, especially for our senior population. Fraudsters often exploit the trusting nature of seniors, making them prime targets for numerous dubious schemes. From phone scams to internet fraud, these deceptive practices can severely impact senior financial well-being and peace of mind. Recognizing these schemes is crucial to safeguarding seniors from exploitation and ensuring their continued security in the digital world.

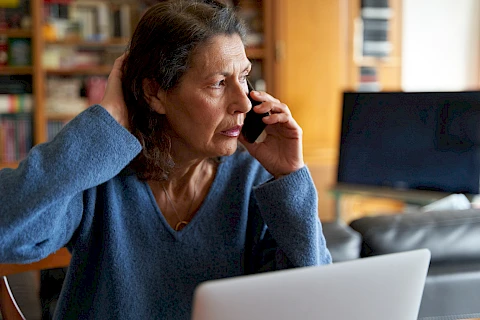

1. Telemarketing/Phone Scams

Telemarketing scams are one of the most common types of fraud targeting seniors. These scams typically involve a call from an "official" source, such as a government office. Fraudsters will often claim the senior owes money or is eligible for a prize. Seniors should be wary of callers asking for immediate payment or sensitive personal information. The best defense is to hang up and independently verify the caller's claims with the supposed source using their official contact details.

2. Internet Fraud

The online world is a landscape for fraudsters. Internet scams can range from phishing emails and fake websites to online shopping scams. Seniors should be cautious of unsolicited emails requesting personal information or payments. Consider "too good to be true" deals on unfamiliar shopping websites as red flags. Installing reputable security software and checking for secure website signs are crucial security practices. Ignoring emails from unknown sources can also help prevent falling prey to internet fraud.

3. Investment Scams

These often involve unique investment opportunities promising high returns. Fraudsters usually pressure seniors to make an immediate decision, exploiting their financial anxieties. If an investment seems too good to be true, it probably is. Seniors should always seek independent financial advice and thoroughly research before committing to any investment.

4. Homeowner/Reverse Mortgage Scams

Fraudsters might approach seniors with attractive home-related offers or loans that appear legitimate but aim to extract money or equity from their homes. Seniors must be wary of unsolicited offers related to their homes and should consult with a trusted financial advisor or attorney before signing any agreements.

5. Sweepstakes & Lottery Scams

In these scams, seniors receive communication announcing they've won a sweepstake or lottery. To claim the prize, they must pay fees or taxes upfront. Seniors should remember genuine lotteries or sweepstakes will never ask for money upfront. Any communication demanding such payments is a scam.

6. The Grandparent Scam

This scam preys on a senior's emotions. It involves a call from a supposed grandchild in distress needing financial help. Seniors should avoid acting hastily. They should verify the situation independently by contacting family members before providing any assistance.

Connect With Senior Helpers for Personalized Support

Understanding fraud schemes affecting seniors is a critical step in protecting themselves. Prevention and awareness remain the best defenses against these malicious schemes.

Senior Helpers of Middle Tennessee is dedicated to the safety and well-being of the seniors in Franklin, Brentwood, Nashville, Columbia, and Lewisburg. If you could use professional in-home care support, require companionship, need help with personal care, or other facts of elderly care, we can help. Contact us to learn more about our services!